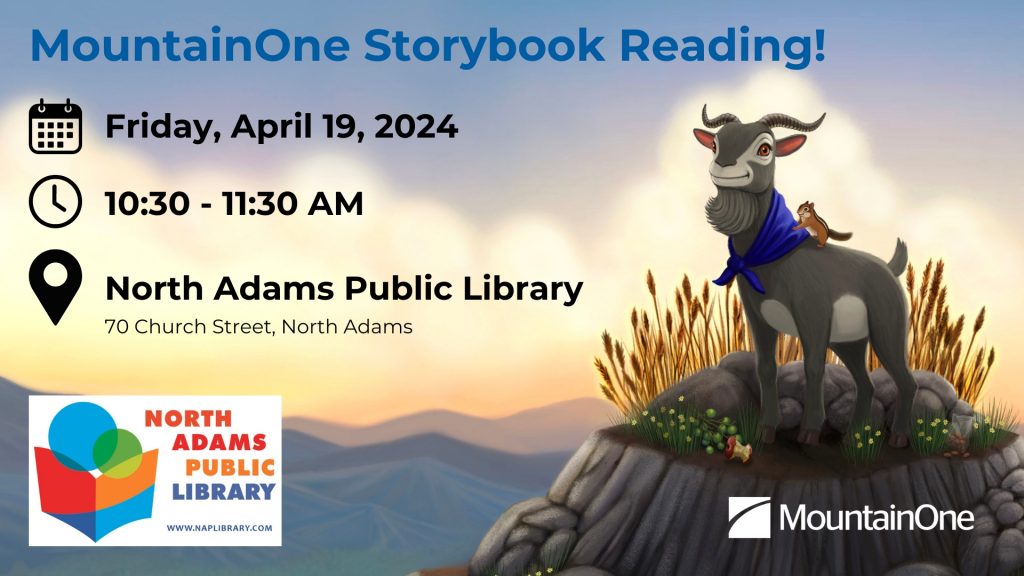

MountainOne is excited to announce the first public reading of its new storybook, “How to Climb a Mountain” on Friday, April 19 from 10:30-11:30 AM at the North Adams Public Library, 74 Church Street.

The charming book follows the beloved MountainOne Spokesgoat as he takes his young audience on a journey that emphasizes the importance of being prepared for the unexpected and facing fears to reach goals.

Bring the whole family for story time, engaging activities, and a special appearance by Mo himself! This event is open to the public. It is the first of many free reading events that MountainOne will host at libraries, elementary schools and MountainOne locations throughout the school year and summer.

“How to Climb a Mountain” is the first in a series of books for children featuring Mo, the MountainOne Spokesgoat. The 24-page illustrated book seeks to promote positive life lessons, literacy, and financial education for MountainOne’s youngest customers.

“Mo embodies the thoughtful and self-assured qualities that lay the foundation to successfully manage finances,” said Robert Fraser, president and chief executive officer, noting that MountainOne is committed to education and service of all its customers, including the youngest. “We look forward to sharing our Spokesgoat’s adventures on April 19th!”

About MountainOne

MountainOne is a mutual holding company headquartered in North Adams, MA. Founded in 1848, MountainOne Bank provides a complete array of personal and business banking and electronic services. MountainOne Bank is Member FDIC and Member DIF. Products and services are offered at full-service offices in the Berkshires (Pittsfield, North Adams, Williamstown) and on Boston’s South Shore (Quincy, Rockland, Scituate).

The financial advisors of MountainOne Investments offer securities and advisory services through Commonwealth Financial Network®, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through CES Insurance Agency or MountainOne Investments. MountainOne Bank is not a registered broker-dealer or Registered Investment Adviser. MountainOne Bank and MountainOne Insurance are not affiliated with Commonwealth.

Insurance and Investments are not insured by the FDIC and are not deposits or obligations of, or guaranteed by, any depository institution. Funds are subject to investment risks, including possible loss of principal investment.