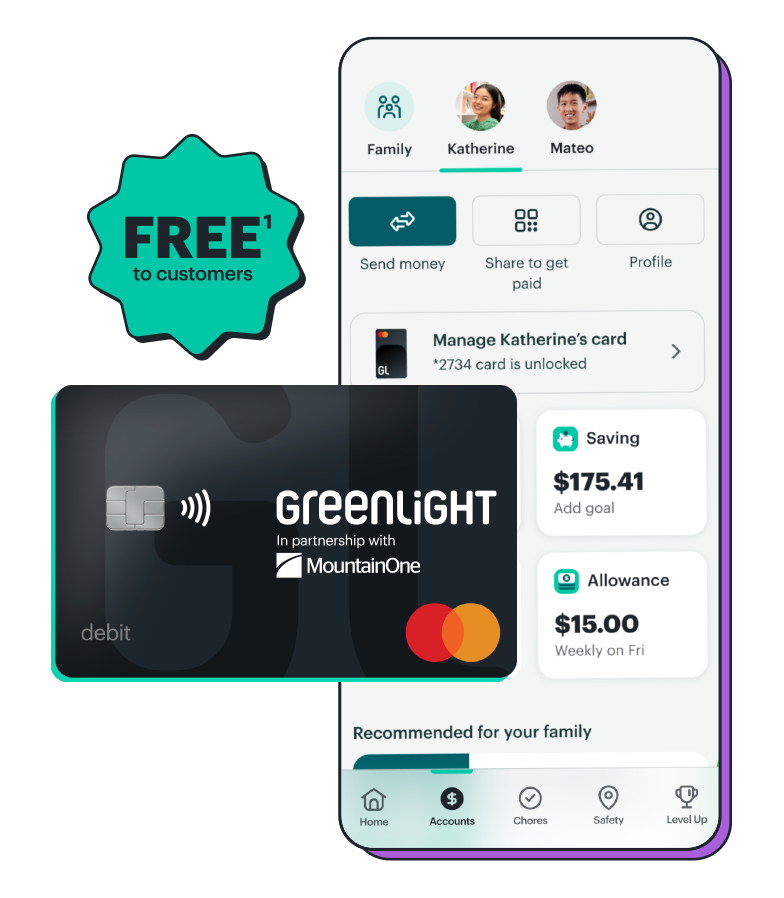

In the Bank’s continued commitment to help the next generation build healthy financial futures, MountainOne is excited to announce the launch of its newest partnership with Greenlight® Financial Technology, Inc.

Greenlight’s debit card and money app for kids and teens teaches financial responsibility through real-life experience. The coinciding parent app allows parents to send money quickly, automate allowances, manage chores, set flexible spending limits, and receive real-time notifications of their child’s transactions. Kids get a taste of financial independence with their very own debit card as well as access to their own app where they can learn how to earn, save, give, and spend wisely within a safe and supportive environment. Together, MountainOne and Greenlight are helping families greenlight their financial independence.

“Partnering with Greenlight is the next phase in our growing suite of services geared toward kids. It supports MountainOne’s mission to help individuals and families achieve financial clarity and confidence, at all ages” said Jill Amato, Senior Vice President, Marketing & Community Banking Officer at MountainOne. “We believe the best financial lessons are learned early and through experience. Greenlight gives parents the tools to turn everyday moments into opportunities for learning, so kids grow up confident and capable when it comes to money.”

Families who connect Greenlight to a MountainOne Bank account are eligible to receive Greenlight for free*, making it easier to help kids build smart money habits at home.

The addition of the Greenlight financial tool further enhances MountainOne’s suite of financial products and educational programs for young people, underscoring its commitment to promoting financial literacy at every stage of development.

“As a parent myself, I have seen how powerful it can be to include kids in real conversations about money,” added Amato. “My own children use Greenlight, and it has been incredible to watch them learn to take ownership of their spending and saving goals. Financial education does not have to be complicated. It starts with conversations, experiences, and the right resources that make learning about money feel approachable and fun.”

For more information, visit mountainone.com/greenlight or stop by any MountainOne branch.

*MountainOne Bank customers are eligible for the Greenlight SELECT plan at no cost when they connect their MountainOne Bank account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer ends 10/27/2028. Offer subject to change or renewal.

The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

About MountainOne Bank

Founded in 1848 and headquartered at 93 Main Street in North Adams, MountainOne Bank (mountainone.com) offers deposit and lending products and services for individuals and businesses. Full-service offices are located in the Berkshires (North Adams, Pittsfield, Williamstown) and Boston’s South Shore (Rockland, Quincy, Scituate). Member FDIC, Member DIF, Equal Housing Lender.